US Economy and Inflation in 2024: Key Economic Policies, Tax Reforms, and Job Creation Strategies

As we move through 2024, the US economy remains a hot topic, with inflation still a major concern. After several turbulent years marked by pandemic disruptions, supply chain issues, and geopolitical tensions, Americans continue to feel the effects of economic uncertainty. In this blog, we’ll explore the current state of inflation, key factors influencing the economy, and the economic policies, tax reforms, and job creation strategies being proposed to address these challenges.

US Current Inflation Situation in 2024

Inflation has been a significant issue since 2021, with prices for everyday goods and services steadily increasing. While there have been some improvements in recent months, inflation in 2024 remains above the Federal Reserve’s target of 2%. The Consumer Price Index (CPI), a measure of the average change in prices over time, shows that core inflation—excluding volatile food and energy prices—continues to be elevated. This persistent inflation affects households in several ways:

- Rising Cost of Living: Prices for essentials such as groceries, rent, and utilities have increased, putting a strain on household budgets.

- Wage Stagnation vs. Price Increases: While wages have seen some growth, they haven’t kept pace with inflation, leading to a decline in real purchasing power for many workers.

- Higher Borrowing Costs: In response to inflation, the Federal Reserve has raised interest rates, which makes borrowing for mortgages, car loans, and credit cards more expensive.

Factors Influencing the US 2024 Economy

Several factors are contributing to the current state of the US economy, creating a complex landscape for policymakers to navigate:

- Supply Chain Disruptions: Ongoing disruptions in global supply chains have led to shortages and higher prices for many goods. Although some supply chain issues have been resolved, bottlenecks in key industries continue to drive up costs.

- Geopolitical Tensions: Conflicts and trade disputes around the world, especially with key economic partners, have increased uncertainty and led to fluctuating commodity prices, particularly in energy and agriculture.

- Labor Market Trends: While the US labor market has shown resilience with low unemployment rates, there are still challenges related to skills mismatches, labor shortages in certain sectors, and the need for job retraining.

- Federal Reserve Policies: The Fed’s monetary policy, including interest rate hikes to curb inflation, plays a critical role in shaping the economic outlook. Although these measures aim to bring down inflation, they can also slow economic growth.

US Economic Policies to Address Inflation and Promote Stability

The economic policies being proposed and debated in 2024 aim to balance curbing inflation with supporting economic growth. Here’s a look at some of the key policy approaches:

- Monetary Policy Adjustments: The Federal Reserve continues to adjust interest rates to control inflation, with a focus on finding the right balance between taming price increases and avoiding a recession. There is ongoing discussion about how long the current interest rate levels should be maintained.

- Targeted Fiscal Policies: The government is considering targeted fiscal policies to support sectors hit hardest by inflation, such as food, energy, and housing. Measures like subsidies for essential goods and services, energy price caps, or housing assistance programs are among the potential options.

- Reducing Supply Chain Bottlenecks: Investments in infrastructure, port facilities, and transportation networks are being prioritized to ease supply chain constraints, which can help lower production costs and reduce inflationary pressures.

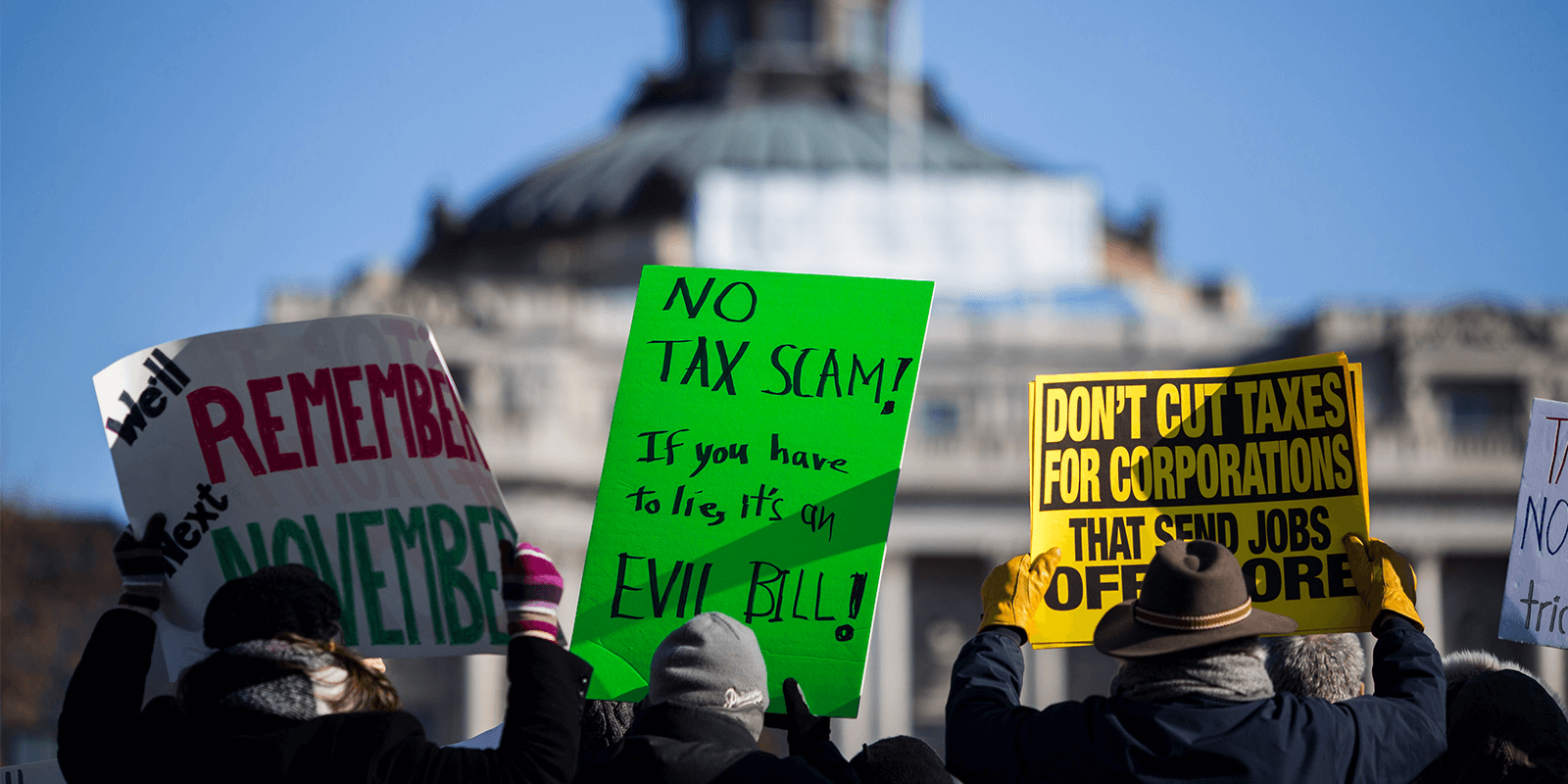

US Tax Reforms: Proposals and Debates

Tax policy is a central issue in economic discussions for 2024, as lawmakers seek to balance revenue generation with economic growth and fairness. Several key tax reform proposals are being debated:

- Corporate Tax Changes: Proposals to adjust the corporate tax rate are on the table, with some advocating for higher taxes on large corporations to fund social programs and infrastructure investments, while others argue for lower taxes to incentivize business growth and job creation.

- Capital Gains Tax Adjustments: Changes to capital gains taxes, particularly on high-income earners, are being discussed to address income inequality and raise government revenue without stifling investment.

- Middle-Class Tax Relief: Some lawmakers are pushing for tax cuts aimed at middle-income households to offset the impact of inflation and provide more disposable income for families.

US Job Creation Strategies for Economic Resilience

As the economy grapples with inflation and uncertainty, job creation remains a priority to ensure economic stability and resilience. Here are some strategies being considered or implemented to stimulate job growth:

- Investment in Green Energy and Technology: The transition to renewable energy and sustainable technologies presents significant job opportunities. Investments in solar, wind, electric vehicle manufacturing, and other green industries aim to create millions of new jobs while addressing climate change.

- Expanding Workforce Training Programs: To address skills mismatches in the labor market, there is a push for more workforce training and education programs, especially in high-demand fields like technology, healthcare, and skilled trades.

- Small Business Support: Small businesses are essential to job creation, and policies that provide access to capital, reduce regulatory burdens, and offer tax incentives for hiring can help stimulate local economies and promote entrepreneurship.

- Infrastructure Projects: The bipartisan infrastructure bill passed in recent years is set to continue generating jobs across construction, transportation, and related sectors. By upgrading roads, bridges, and public transit systems, these projects not only create immediate employment opportunities but also lay the foundation for long-term economic growth.

US Outlook for 2024: Navigating a Path Forward

The US economy in 2024 is marked by challenges and opportunities. While inflation remains a significant issue, policymakers are employing a range of strategies to stabilize prices and promote growth. The combination of monetary policies, targeted tax reforms, and job creation initiatives is crucial in shaping the economic outlook. However, much will depend on how effectively these policies are implemented and whether they can address the underlying factors driving inflation.

For Americans, the road ahead may still be bumpy, but there is potential for a more stable and prosperous economic future. Staying informed about policy developments and engaging in the democratic process will be essential for navigating this period of economic uncertainty.

The US inflation rate and economic landscape in 2024 present a complex challenge for policymakers, businesses, and households alike. As leaders propose various economic policies, tax reforms, and job creation strategies, the goal remains to stabilize prices, foster economic growth, and improve the quality of life for all Americans. Understanding these dynamics can help individuals make informed decisions and prepare for the changes that lie ahead.

Let’s continue to monitor these developments and advocate for policies that support a stronger, more resilient economy.

:max_bytes(150000):strip_icc()/GettyImages-2003724854-2aff2851bdba49d3aa4d53a8323cadf8.jpg)

Comments

Post a Comment